1. Review of the graphite electrode market in 2023

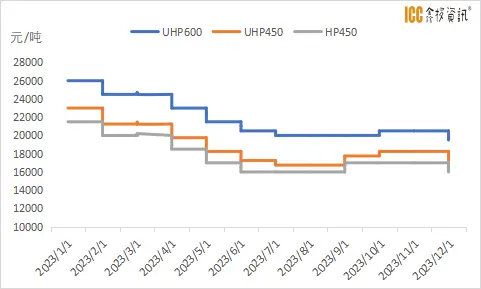

In 2023, the graphite electrode market will show a weak situation of supply and demand, and the decline in the operating rate of short-process steelmaking will lead to a weakening demand for graphite electrodes, and the overall price of graphite electrodes will show a volatile downward trend, and the industry will lose money across the board.

2. Market supply – “production control and production reduction” throughout the year

2. Market supply – “production control and production reduction” throughout the year

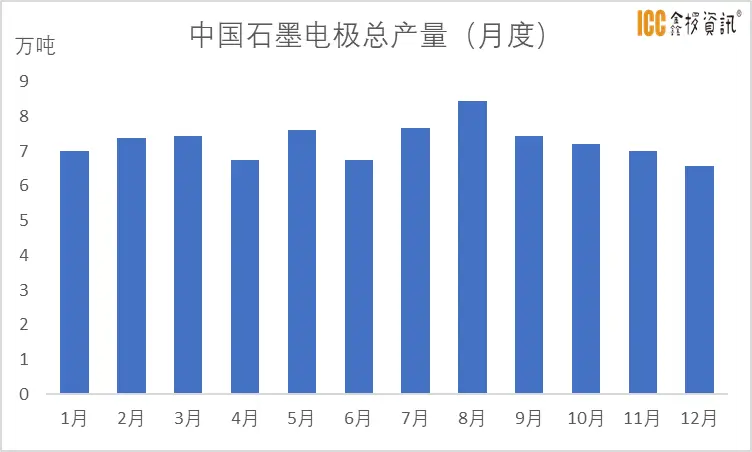

In 2023, under the continuous weakening of the overall market demand, “production control and production reduction” has become the norm for graphite electrode manufacturers, and the capacity utilization rate of the graphite electrode industry has declined significantly, according to ICC statistics, the capacity utilization rate of China’s graphite electrodes in 2023 will be 43.5%, and the annual output of graphite electrodes in 2023 will be 872,500 tons, a year-on-year decrease of 12.75%. In 2023, the output of the head graphite electrode enterprises will be stable, and the output will decline significantly more from some small and medium-sized manufacturers or enterprises with incomplete processes.

3. Market demand – less than expected, weak performance

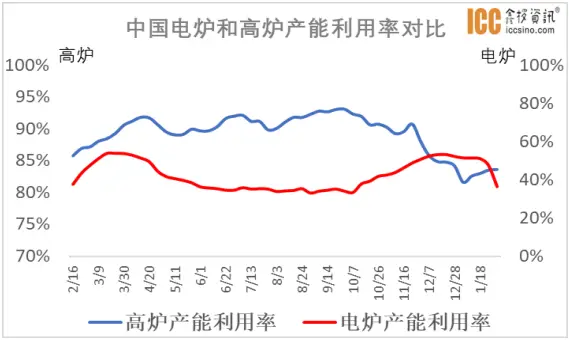

The demand for graphite electrodes in 2023 will total 900,000 tons, and the steel industry is still the main downstream of graphite electrodes. From the perspective of graphite electrode demand structure, China’s steel industry will be weak in total demand in 2023, and the profits of iron and steel enterprises will decline as a whole, and in the first half of 2023, China’s electric furnace steel output has been suppressed by converters. After the second half of the year, due to the continued high price of coke, the price of scrap steel was suppressed by the flat control of the output of the steel mill, resulting in the electric furnace steel mills began to enjoy dividends, and the output rebounded for 11 consecutive weeks from the fourth quarter, and the profit at the end of the year was 100-200 yuan higher than that of the blast furnace.

4. Export pattern – Russia’s total export volume ranks first

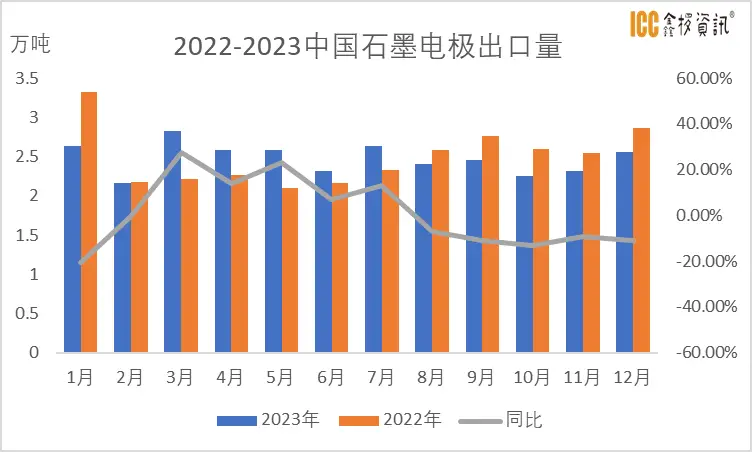

In 2023, China’s graphite electrode import and export will total 297,100 tons, a year-on-year decrease of 0.68%, which is basically the same as the export volume in 2022.

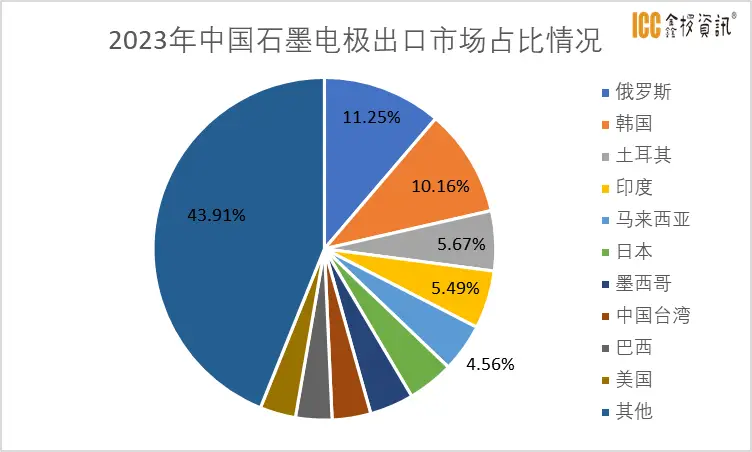

In 2023, China’s main graphite electrode export countries: Russia, South Korea, Turkey, India, Malaysia, affected by the Russian-Ukrainian war and EU anti-dumping, the proportion of China’s graphite electrode exports to Russia in 2023 will increase, and the proportion of exports to EU countries will decrease, and the export market competition will be fierce.

5. Market forecast

As far as the current situation is concerned, China’s carbon industry has entered the stage of rapid reshuffle (2~3 years). In view of this situation, from the current development of the domestic steel market, the demand side has not yet formed a significant recovery judgment and consensus, and the overseas market demand is expected to gradually expand in 2024, thereby driving the export of graphite electrodes in China, which is mainly due to the fact that the European side of the tax on carbon emissions is significantly stricter than that in China, which will be more conducive to the increase of European electric furnace steelmaking output, and the cancellation of export restrictions will expand the downstream market scope of Chinese graphite electrode enterprises, and graphite electrode enterprises may actively participate in overseas markets in 2024。

6. How to break the situation

The graphite electrode market continues to compete at low prices, and it is estimated that it is difficult to have a real winner. In the crazy involution of the domestic market, enterprises should seek new breakthrough directions, improve product quality, develop large-scale electrodes or set their sights on overseas markets, to avoid the same dimension of fierce competition, reshuffle, survival of the fittest, enterprises need to “take precautions” and seize the opportunity to overtake in corners.

Post time: Feb-27-2024